Interest income of 2.8 trillion increased by 9%… Non-operating loss of KRW 277.7 billion due to ELS compensation

Dividend resolution of 540 won per share for the first quarter… “Incineration of 300 billion won of treasury stock during the 2nd and 3rd quarters”

(Seoul = Yonhap News) Reporter Shin Ho-kyung = Shinhan Financial Group’s net profit in the first quarter was close to 5% compared to the same period last year due to compensation costs for Hong Kong H Index (Hang Seng China Enterprise Index) equity-linked securities (ELS) losses exceeding 270 billion won. decreased.

Shinhan Financial Group CI [신한금융그룹 제공]

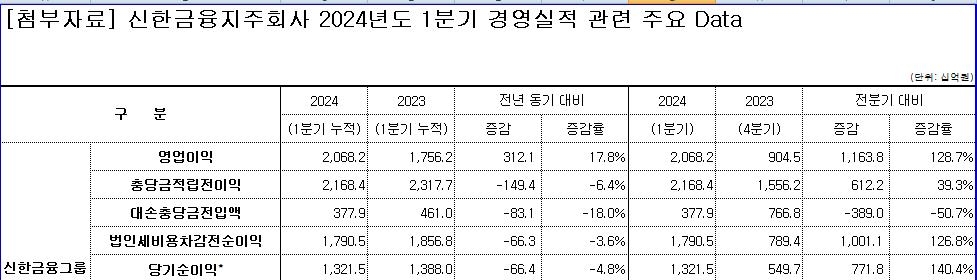

Shinhan Financial Group announced on the 26th that its net profit for the first quarter (based on net profit from shares of the parent company) was KRW 1.3215 trillion, down 4.8% from the first quarter of last year (KRW 1.388 trillion).

Operating profit increased by 17.8% from KRW 1.7562 trillion to KRW 2.0682 trillion, but non-operating profit and loss decreased from a profit of KRW 106 billion to a loss of KRW 277.7 billion.

This non-operating loss included 274 billion won in voluntary compensation costs for H index ELS loss customers as an accounting ‘provision’.

An official from Shinhan Financial Group said, “Even in a difficult market environment, we achieved good performance based on solid fundamentals and a diversified business portfolio.”

[신한금융지주 제공.재판매 및 DB 금지]

Shinhan Financial Group and Shinhan Bank’s first quarter net interest margin (NIM) was 2.00% and 1.64%, respectively, up 0.03 percentage points (p) and 0.02 percentage points from the fourth quarter of last year (1.97%, 1.62%). Compared to the first quarter of last year (1.94·1.59%), it is 0.06%p and 0.05%p higher, respectively.

Accordingly, the group’s interest income in the first quarter (KRW 2.8159 trillion) also increased by 9.4% compared to the same period last year (KRW 2.5738 trillion). It is 1.1% higher than the fourth quarter of last year (KRW 2.7866 trillion).

Non-interest income (KRW 1.025 trillion) increased only 0.3% from a year ago. Profits related to securities decreased due to changes in market interest rates and exchange rates, but commission profits related to credit cards, securities trading, and investment banking (IB) increased.

An official from Shinhan Financial Group said, “Interest income increased due to asset growth and margin improvement centered on bank corporate loans, and non-interest income also increased due to an increase in commission income such as credit card commissions, securities custody commissions, and insurance profits and losses from affiliates including Card, Securities, and Life.” “I did,” he explained.

In the first quarter, Shinhan Financial Group accumulated 377.7 billion won in loan loss provisions. It decreased by 18.0% and 50.7%, respectively, from the first quarter of last year (KRW 461 billion) and the previous quarter (KRW 766.8 billion).

An official from Shinhan Financial Group said, “Additional provisions have decreased compared to the first quarter of last year, and preemptive provisions have decreased compared to the fourth quarter. However, the loan loss cost ratio as of the first quarter is stable at 0.38%.”

By affiliate, Shinhan Bank’s first quarter net profit (KRW 928.6 billion) decreased by 0.3% from a year ago (KRW 931.5 billion) due to the ELS compensation, and Shinhan Investment & Securities (KRW 75.7 billion) also decreased by 36.6%.

On the contrary, Shinhan Card (KRW 185.1 billion) and Shinhan Life (KRW 154.2 billion) increased by 11.0% and 15.2%, respectively.

Shinhan Financial Group held a board meeting this morning and decided on a dividend of 540 won per share for the first quarter, and also decided to acquire and cancel treasury shares worth 300 billion won during the second and third quarters.

An official from Shinhan Financial Group said, “This year, we will continue to strive to consistently and continuously improve shareholder value while maintaining an appropriate capital ratio.”

Report via KakaoTalk okjebo

< em>

Unauthorized reproduction/redistribution, AI learning and use prohibited>

2024/04/26 13:26 Sent

Tags: Shinhan Financial Groups quarter net profit KRW trillion #5.. ELS provisioned liabilities KRW billion comprehensive

-